tax benefit rules for trusts

The trusts income is separated into two parts for tax purposes. Find out more by reading the information on.

Consider Combining The Tax Benefits Of A Preferred Family Limited Partnership With A Grat

A Health and Education Exclusion Trust HEET can be used to pay for the educational or medical expenses of grandchildren with two primary tax benefits.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Select Popular Legal Forms Packages of Any Category. Income tax charitable deductions for trusts and estates are governed by Sec.

Instead trusts provide a way to transfer property before or upon the death of a person without the hassle delay cost or. General Rule Who Pays the Tax on EstateTrust Step 1 Income to Beneficiaries. The two most important tax forms for trusts are the 1041 and the K-1.

If a trust has. I The Central Government. Beneficiary income and trustee income.

Assets in a revocable trust are included in the grantors gross estate for federal estate tax purposes. An inter-vivos trust generally pays tax on all income at the top federal and provincial tax rate for individuals. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable income in 2021 individuals do not reach this bracket until their taxable income.

If certain conditions are met. Sometimes the settlor can also benefit from the assets in a trust - this is called a settlor-interested trust and has special tax rules. Form 1041 is similar to Form 1040.

Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. 642 c these rules are substantially. 2 reduction of tax liabilities and probate costs.

1 ongoing professional management of assets. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. On this form the trust deducts from its own taxable income any interest it distributes to beneficiaries2 At the same time the trust issues.

For most people the advantages of trusts do not involve tax savings. The tax on these two parts is then calculated separately to arrive at the total tax. All Major Categories Covered.

Revocable trusts also called living trusts are one of the more. Tax rates can be high on income kept within a trust so it may be tax efficient to distribute most of the income but keep the principal within the trust. Is the lessor of distribution to beneficiaries or estatetrust income Step 2 Income to Trust.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Ii The Central Board of Direct Taxes. Charitable and religious trusts and institutions entitled to various kinds of tax incentives under the I-T Act is briefly as follows.

Trusts have many varied uses and benefits primary among them. Charitable income tax deductions for trusts and estates. A trust is not allowed to claim personal tax credits.

For example if a single taxpayer has 250000 of dividends and no other income 50000 will be subject to the 38 NIIT which is an additional tax of 1900. Is the trust. If the trust or estate has taxable income in a given year the fiduciary may elect to treat charitable distributions made in the subsequent year as paid in the first year.

Trusts also can be. From Fisher Investments 40 years managing money and helping thousands of families.

Tax Advantages For Donor Advised Funds Nptrust

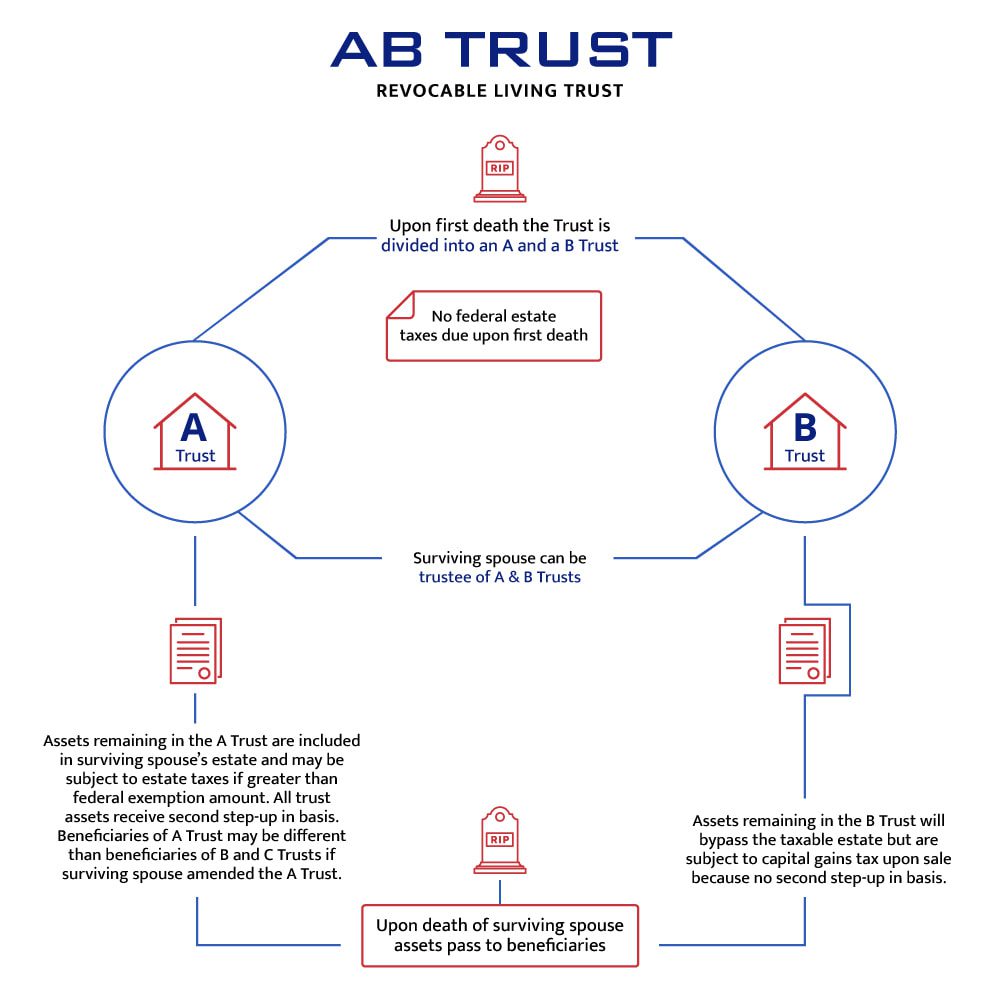

To A B Or Not To A B That Is The Question Botti Morison

What Is A Step Up In Basis Cost Basis Of Inherited Assets

To A B Or Not To A B That Is The Question Botti Morison

Tax Benefits Of Agricultural Investments Investing Business Diary Tax

Trust Registration Service 2020 Trust Tax Rules Online Trust

Pin By Debbie Wolfe On Trusts Estate Tax Tax Return

Tax Forms Capital Gain Irs Tax Forms

Pin By The Taxtalk On Income Tax Prove It Sourcing Credits

Exploring The Estate Tax Part 2 Journal Of Accountancy

How The 7 Year Inheritance Tax Rule Works Inheritance Tax Tax Rules Inheritance

Distributable Net Income Tax Rules For Bypass Trusts

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Some Trust Distributions Are Subject To Tax Distributions Can Be Structured In Different Ways Revocable Living Trust Estate Planning Attorney Estate Planning

Jk Lasser S New Rules For Estate Retirement And Tax Planning Ebook By Stewart H Welch Iii Rakuten Kobo Free Books Online Books To Read How To Plan

All You Need To Know About Institutional Donors In Your Fundraising Strategy For Your Non Profit Proposa Fundraising Strategies Grant Writing Proposal Writing

The Generation Skipping Transfer Tax A Quick Guide

How To Find The Best State To Place Your Trusts Retirement Watch Retirement Lifetime Income Investment Advice