federal unemployment benefits tax refund

The total unemployment compensation was 10201 or more. State Taxes on Unemployment Benefits.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Tax Refunds On Unemployment Benefits Still Delayed For Thousands.

. Unemployment compensation is taxable income which needs to be reported by filing an income tax return. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. They dont need to file an amended.

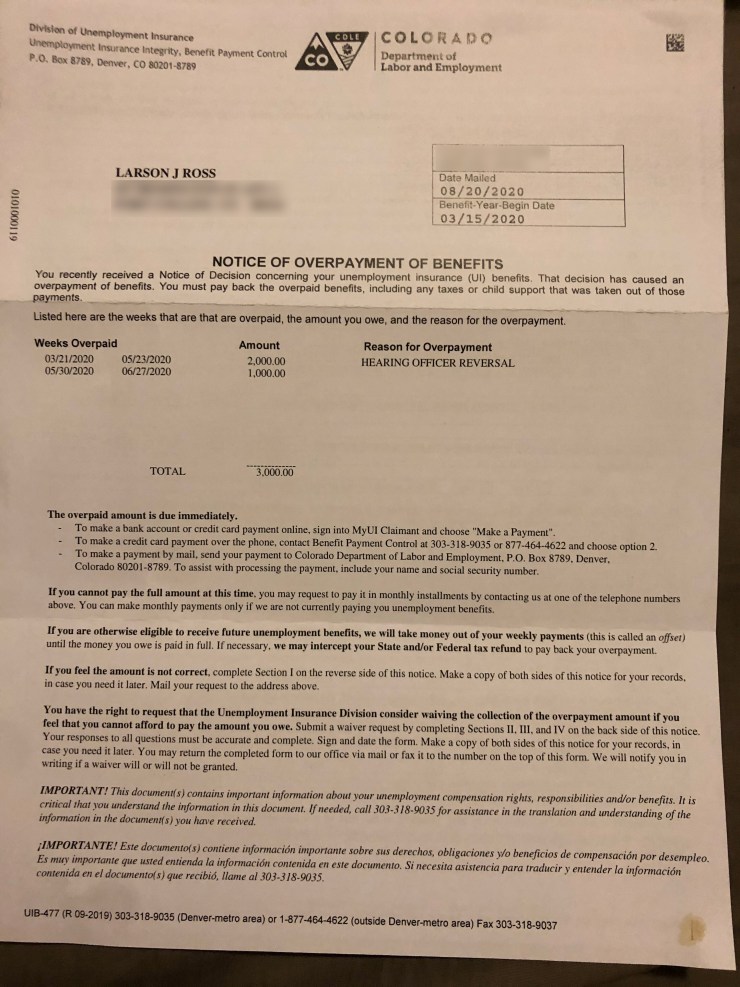

If you didnt repay overpayment of unemployment benefits in the same year Include the benefits in income for the year they. It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. This tax break was applicable.

IR-2021-212 November 1 2021. In the latest batch of refunds announced in November however the average was 1189. The IRS has sent 87 million unemployment compensation refunds so far.

Ad File your unemployment tax return free. Enter the figures from your form on the eFile platform and the Tax App will calculate the taxes owed on. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May.

You should receive a 1099-G reporting the unemployment compensation you received during 2021 to be reported on your 2021 Return in 2022. You will receive back a percentage of the federal taxes withheld based on the amount of unemployment that was repaid in 2021. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

In some cases when Form 1099-G Certain Government Payments information was not available the IRS automatically allowed an exclusion amount of up to 20400 for married individuals who live in a non-community property state and who filed a joint 2020 tax return when. Normally any unemployment compensation someone receives is taxable. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000.

It would make tax reporting simpler if you repay the entire amount in 2021. Report the difference as unemployment compensation. The IRS has already sent out 87 million.

Couples can waive tax on up to 20400 of benefits. All of the federal taxes withheld will be reported on the 2021 return as a tax payment. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. Use the Unemployment section under Wages Income in TurboTax. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

State Income Tax Range. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. You should receive.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. The second phase includes married couples who file a joint tax return according to the IRS. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Thats the same data. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The IRS will issue refunds in two phases.

Individuals should receive a. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. IR-2021-159 July 28 2021.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income.

The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. Congress hasnt passed a law offering. Unemployment compensation is taxable in South Carolina to the same extent its taxed under federal law.

If you repaid the overpayment of unemployment benefits in the same year you received them Subtract the amount of unemployment repayment from the total taxable amount you received. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. 100 free federal filing for everyone.

This is not the amount of the refund taxpayers will receive. The American Rescue Plan Act which was passed by Congress last March waived federal taxes on some unemployment benefits that were collected in 2020. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. Unemployment benefits received in 2021 are taxed as ordinary income like wages but are not subject to Social Security and Medicare taxes. Check For the Latest Updates and Resources Throughout The Tax Season.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. 3 on taxable income. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. President Joe Biden signed the pandemic relief law in March.

Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

The regular rules returned for 2021. The IRS efforts to correct unemployment compensation overpayments will help most of the affected. This assistance covered unemployment benefits.

COVID Tax Tip 2021-46 April 8 2021. The American Rescue Plan a 19 trillion Covid relief bill. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Irs Unemployment Refunds What You Need To Know

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

State Income Tax Returns And Unemployment Compensation

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Compensation Are Unemployment Benefits Taxable Marca

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

When Will I Get My Unemployment Tax Refund Hanfincal

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

1099 G Unemployment Compensation 1099g

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

![]()

What To Know About Unemployment Refund Irs Payment Schedule More